The Stock Market is also known as the equity market. It is a very luring and addictive business, which helps you multiply your money if you know the tricks of the trade.

Being an

Investor, one should know about the Top Share Market websites to execute stock

analysis in India. Investing in the share market requires a factual set of knowledge

and skills. For improving your knowledge and skills it is required to get

updates frequently.

Let’s have a look at the top research Websites that give detailed insights about the Share market.

TRADING VIEW

https://in.tradingview.com/ is a popular name among financial websites. It offers accurate

data related to the stock market, business sector, and the financial domain. One

can visit this website and get the latest updates from the financial market. It

allows traders to access financial data on the go from any part of the world.

They can learn

about stock prices, futures, indices, Forex, Bitcoin, and other topics from

this site. Trading View has strong backup support that offers accurate data

collected from reliable sources. Therefore, people relying on this website for

making financial decisions will never go wrong.

TradingView

ensures users have the best experience on visiting the website as it is loaded

with impressive features. Besides national indices, TradingView is also useful

for learning about the latest data of global indices.

NSE INDIA

https://www.nseindia.com/ is the official website of the National stock exchange (NSE).

You can get the financial information and stock quotes of all the companies

listed on NSE exchange. The information provided on this website is accurate

and consistently updated.

There are tons

of historical data regarding NSE and nifty available on this website. You can

find information about the corporates, domestic and foreign investors, new

listings, IPOs, etc. NSE India also provides courses and certifications.

MONEY CONTROL

https://www.moneycontrol.com/ is certainly the most

popular website among Indian stock investors. You can find all sorts of

information on this website like market news, trends, charts, livestock prices,

commodities, currencies, mutual funds, personal finance, IPOs, etc.

For equity

investors, here you can find the fundamental data of any company along with

technical indicators (including candlesticks charts). Moneycontrol website also

provides a platform to track your investments and to create your own wish list.

Further, the

discussion forum offered by this website is also among one of the unique

features of this website. If you are unable to find the latest news regarding

the drastic share movement of any company, just go to the forum of the stock,

and read the discussions.

INVESTING.COM

https://in.investing.com/ is a great site if you want to find comprehensive information regarding a public company. You can perform both fundamental and technical analysis of stocks on this website.

The different

pieces of information available on this website are general info, chart, news

and analysis, financials, technicals, forums, etc. You can also use a number of

amazing ‘tools’ available on this website for free.The best one is the ‘Stock

screener’. Using this tool, you can screen stocks and shortlist them based on

different criteria like market capitalization, PE ratio, ROE, CAGR, etc.

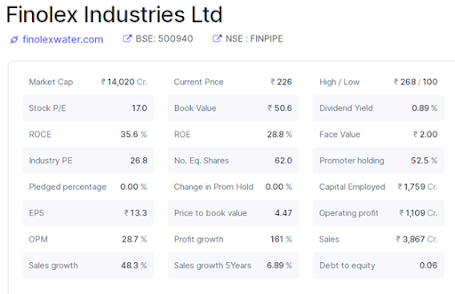

SCREENER

https://www.screener.in/ is a great website to perform the fundamental analysis of a

company like reading its financial statements, ratios, etc. Most of the

features on Screener are absolutely free.

You can find a

number of important information about the companies on this website like

financial ratios, charts, analysis, peers/competitors, quarterly results,

annual results, profit & loss statements, balance sheet, cash flows, etc.

Anyone can

easily read the annual reports, balance sheets, etc on this website because of

the user-friendly display of the data. I regularly use this website to check

the financials of a company and will also recommend using this website.

Finally, If one thing

ties all these investment news and market data research tools together, it’s

their appeal to self-directed investors — people looking to create and manage

their own portfolios.

Knowledge is

power, whether or not you’re in the driver’s seat.

Open demat account with India's No-1 broker ZERODHA....

https://zerodha.com/?c=JU8434&s=CONSOLE