Multibagger stocks are those that provide returns that are greater than their cost. Prices of such Multibagger Stocks India continue to multiply, increasing in value two, three, and even 10 times. Identifying potential midcaps/large caps equities from current small caps stocks is the technique of spotting multi-baggers.

They are

stocks that evolve gradually; they will not provide rapid rewards if you invest

in them. A fundamentally sound small-cap firm with good management and a

long-term strategy will eventually become a multi-bagger. Investors looking to

build capital with decent risk appetite aim to get their hands on multibaggers.

The idea of a

multibagger is thought to have started with Peter Lynch, who referred

to "10-baggers" in his seminal investing book, One Up on Wall Street.

The term stems from baseball, in which players rack up "bags" by

running around the bases.

How to

identify them?

Future growth

potential:

One should

have a sound knowledge of the products that the company is manufacturing along

with its demand, going further, as well as the economic aspects of the industry

and the country as a whole. An investor should invest in a stock, which has

high growth prospects.

High margin

business and healthy profitability growth:

Look for

businesses, which enjoy higher profitability margins as well as higher entry

barriers. Apart from this, one should also check the financial track record of

the company to check if it’s growing at a faster pace than the industry.

Competitive

advantage:

It’s perhaps

one of the best ways to identify multibagger stocks. A company can stay in the

competition by offering better services & products as it grows. For this,

it is necessary that the products are unique and better than its

competitors.

Strong and capable management:

A business

cannot succeed without a management team that is capable as well as strong.

Looking at multiple aspects like governance practices, board independence,

diversion of funds to other businesses or for personal interest, pledging of

shares, discipline with obligations, and financial matters, etc. will help you

determine the strength of the management team.

Remain

patient:

Last but not

the least, the stock market is a game of patience; never lose it! A

multi-bagger stock sometimes may take some time to take off. Be confident in

your idea & research, and let time do the rest for you.

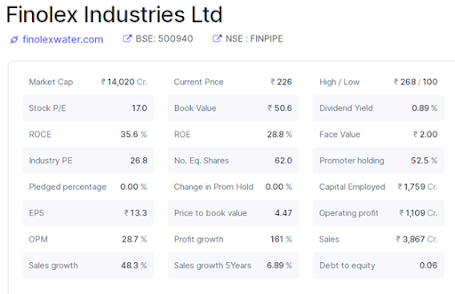

1) Finolex

Industries Ltd

Current Market

Price – Rs.226/- Target - Rs.

470/-

2) Sumitomo

Chemical India Ltd

Current Market

Price – Rs.375/- Target - Rs. 660/-

3) Tata Elxsi Ltd

Current Market

Price – Rs.5,809/- Target - Rs. 9850/-

4) Affle India

Ltd

Current Market

Price – Rs.1,043/- Target - Rs. 1980/-

5) Indian Energy

Exchange Ltd

Current Market

Price – Rs.700/- Target - Rs. 1480/-

Overall,

investing is all about focusing on your financial goals and ignoring the busy body

nature of the markets and the media that covers them. That means buying and

holding for the long haul, regardless of any news that might move you to try

and time the market.

Open demat account with India's No-1 broker ZERODHA....

No comments:

Post a Comment